Source: CNN

November 1, 2019

New York (CNN Business) – Tom Kacsmar worked underground at a coal mine for nearly four decades. The promise of a decent pension and healthcare for life kept him at this dangerous job. Now, Kacsmar fears those benefits will get washed away by the bankruptcy of Murray Energy, America’s largest private coal mining company.

“I was a proud, hard-working coal miner my entire life. With the stroke of a pen, they’re going to cut my healthcare,” the 76-year-old retiree told CNN Business.

Kacsmar never worked a day for Murray Energy, the mining giant founded by coal king Robert Murray. But like countless other retirees, the fate of his benefits is inextricably linked to the company, which is seeking to “dramatically” slash its liabilities, including $8 billion of pension and retiree healthcare obligations.

Murray built his empire by gobbling up smaller miners, including the Ohio company Kacsmar used to work for.

“I was led to believe that if I did my job, I would have a pension and healthcare for the rest of my life,” Kacsmar said. “There is something wrong with the laws in this country that put the employees last in line to receive anything.”

Murray Energy is the last major funder of industry pension plan

Like many of its bankrupt rivals, Murray Energy is widely expected to make the case that those benefits need to get dialed back for the company to survive.

That would have far-reaching consequences because Murray Energy is the last major company contributing to the United Mine Workers of America’s pension plan. That plan provides pension benefits to about 87,000 retired miners and surviving spouses, who collect an average monthly pension of about $600.

George Shultz retired a decade ago from Consul Energy, a company later acquired by Murray Energy.

Now the 69-year-old worries his pension will get gutted, potentially costing him his home.

Current and former Murray Energy employees told CNN Business they are bracing for cuts.

“I’m really worried. I know they are going to wipe away my pension,” said Ryan Cottrell, a father of two who works at a West Virginia coal mine owned by Murray Energy. “This bankruptcy is clearly to strip pensions and retirees’ benefits.”

George Shultz bought a house with his wife when he retired in 2009 from Consul Energy, one of the companies acquired by Murray.

“If I lose that pension, I’m going to lose that house,” said Shultz, whose wife recently passed away.

Coal is getting crushed

The bankruptcy of Murray Energy puts an exclamation point on the stunning downfall of America’s coal industry. Despite President Donald Trump’s promise to revive coal country, the shift towardnatural gas and renewable energy has only accelerated.

US power plants are expected to consume less coal next year than at any point since Jimmy Carter was in the White House, according to projections by the federal government.

“Although Murray has been able to outlast many of its competitors, mounting debt and legacy liability expenses have become too heavy of a burden to sustain under current industry conditions,” Robert Moore, the company’s incoming CEO, argued in court documents. “The company has exhausted all options and liquidity.”

Murray Energy declined to comment on what will happen to worker pensions, but legal experts say retirees and workers have reason to worry.

Murray Energy “will seek to eliminate or reject the collective bargaining agreement as well as any obligations to fund retirement medical benefits,” said Gregory Plotko, an attorney at Richards Kibbe & Orbe who represented the union and other creditors in the Patriot Coal bankruptcy.

Coal miners can’t rely on the Pension Benefit Guaranty Corporation, the federal agency created in the 1970s to protect worker retirement plans.That’s because the PBGC is not required to cover 100% of multiemployer pension plans like the coal industry’s. And in any case, the agency doesn’t have the funding to do so. The PBGC projects that its program will run out of cash by the end of 2025.

Lawmakers in Congress have been debating for years how to reform this safety net before it becomes insolvent.

‘Nervous and scared’

Bankruptcy courts have in the past allowed coal companies to shed those expenses — a point that Murray Energy didn’t shy away from noting in its court filings.

“Competitors have used bankruptcy to reduce debt and lower their cost structures by eliminating cash interest obligations and pension and benefit obligations, leaving them better positioned to compete for volume and pricing in the current market,” Murray Energy said in court documents.

The company emphasized that it doesn’t take this process lightly.

“Murray’s employees are its lifeblood and Murray has a longstanding history and valued partnership with their unions,” the company said.

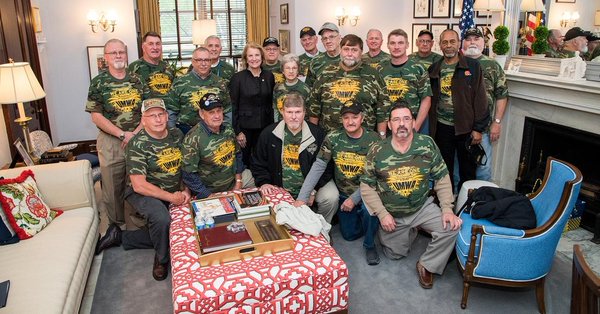

Ryan Cottrell, a West Virginia coal miner who works at Murray Energy, with his wife Kendra, son Hunter and daughter Harper.

However, Murray Energy’s lawyers said the company is “simply not able to repay” its liabilities, including its “outsized” pension and retiree healthcare obligations. The mining giant argued it must slash its liabilities to attract the capital needed to fund future operations.

Current and former coal miners expressed frustration at the situation, especially because they took less pay during previous contract negotiations in order to protect their pensions.

“People are nervous and scared. They don’t know what to do,” said Gary Campbell, who works at a West Virginia coal mine owned by Murray Energy. “Why is there no help for us? Why is everyone piling on the coal industry? It seems like we take it on the chin, again and again.”

Pressure on lawmakers for solution

Sheila Slocum Hollis, a partner and energy specialist in the law firm Duane Morris, warned that the impact of these coal bankruptcies can be “extremely devastating” on local communities. Property values plunge, even as the strain on resources rises.

“The country owes these people a lot for the sacrifices they’ve made and the risks they’ve taken,” Hollis said. “If the company isn’t there because of the bankruptcy, somebody needs to step up to help the people left high and dry.”

In this case, even coal miners who never worked for companies related to Murray Energy could be affected. After a wave of bankruptcies over the past decade, Murray Energy is the last man standing funding the union pension plan, which is known as the 1974 Pension Plan. Murray Energy helps fund pensions for people who worked for other bankrupt coal companies but still rely on that industry pension plan.

The company estimates it funds a “staggering” 97% of the plan’s total contributions, totaling $15 million in 2018 alone.

“If Murray stops contributing, the pension plan will be unable to pay out benefits to all of its members,” said Plotko, the lawyer.

Murray Energy said in court documents that if it withdraws from the plan, it would be on the hook for $6.4 billion — an amount the company almost certainly can’t afford.

Senator Sherrod Brown, the Ohio Democrat, said in a statement that the Murray Energy bankruptcy “intensifies the urgent need for a comprehensive solution to the imminent pension crisis.”

Brown pledged to work with lawmakers to find a bipartisan solution to “get the job done for these workers who have worked so hard for this country.”

‘Poor management’

The rise of Murray Energy was made possible by the misfortunes of its rivals. The company made a string of purchases of struggling companies, including Consul Energy, Foresight Energy, Armstrong Energy and assets in Colombia.

“Throughout the downturn, Murray has capitalized on opportunities to make value-accretive asset acquisitions,” the company said in its bankruptcy documents.

Those deals, Murray argues, boosted earnings and gave the company additional assets to pledge to creditors to refinance debt.

Murray Energy coal mine worker Ryan Cottrell.

However, doubling down on the coal industry also further exposed the company to the same challenges facing all miners. And it added stress to Murray’s balance sheet, which the company admits is saddled with “mounting debt” and hefty interest payments.

Some workers argue that empire-building strategy backfired.

“Honestly, he got too big for his britches,” said Cottrell, one of the West Virginia miners. “We ended up in bankruptcy because of poor management.”