Source: Phoenix News Times

March 17, 2020

A member of the Navajo Nation has tested positive for the novel coronavirus, according to the Navajo Department of Health.

On Tuesday, a 46-year-old individual from Chilchinbeto, Arizona, a community on the Navajo Nation known as Tsii’chin Bii’ Tó in Navajo language, was confirmed to have COVID-19.

After first reporting symptoms at the nearby Kayenta Health Center in Kayenta, Arizona, the individual was transferred to a hospital in Phoenix, where the Arizona Department of Health confirmed the positive test result, according to a press release from the Navajo Nation Office of the President and Vice President.

It’s the first case within the Navajo Nation, a tribal nation larger than 10 U.S. states.

“We have health and emergency experts who have been planning and preparing for this situation for several weeks,” said Jonathan Nez, president of the Navajo Nation, in the release. “We call upon our Navajo people to do their best to remain calm and make good decisions by staying home to prevent the spread of the virus among our communities.”

Health and emergency officials are taking the proper precautions to screen and isolate the person’s family members, he added.

Nez said his office is in close contact with officials from the Kayenta Indian Health Service Unit, Arizona Department of Health, Navajo County, and Navajo Area Indian Health Service to inform the public and implement necessary precautions moving forward.

In light of this first confirmed case, Nez and Vice President Myron Lizer urged the Navajo Nation Council, the legislative branch of the Navajo government, to convene to discuss appropriating funds to address the pandemic.

The Council failed to approve a $3 million funding request to the Department of Emergency Management earlier this week to purchase additional COVID-19 test kits, respirators, masks, and other preventative equipment earlier.

The Navajo Agricultural Products Industry is contributing $1 million to help the Nation address the spread of the COVID-19 coronavirus, according to the press release.

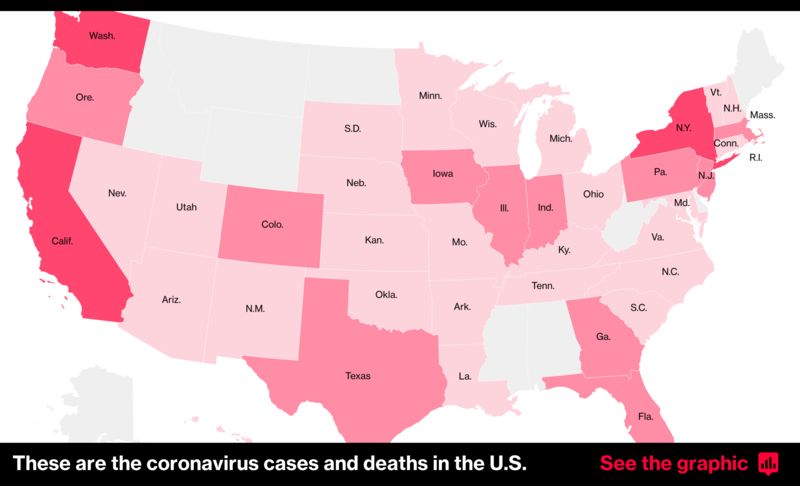

As of today, the death toll has reached 100 in the United States. There are 20 confirmed cases within Arizona.

Nez and Vice President Lizer will provide more information about the confirmed case of a Navajo community member live at 4 p.m. Arizona time on Wednesday on Navajo radio station KTNN, which is broadcast in northern Arizona on AM 660 and 101.5 FM. If the public has questions, Nez encouraged people to contact the Navajo Health Command Operations Center at 928-871-7014.

Meanwhile, Monument Valley in the Navajo Nation closed temporarily due to COVID-19 concerns, as did the four Navajo casinos.

By: Hannah Critchfield