The United Mine Workers of America (UMWA) takes a unique approach to union membership and support, extending its commitment to members far beyond their active working years. Even after miners retire, their affiliation with the UMWA continues, and so do the critical benefits provided through the UMWA Health and Retirement Funds. These funds represent a substantial financial commitment, disbursing over $1 billion annually in pensions and health care benefits. This support doesn’t just help individual retirees—it contributes to the economic health of entire communities.

When these benefits are distributed, they directly impact the local economies where retirees and their families live. Retirees use their benefits to purchase goods and services in their communities, from groceries and household supplies to larger purchases. This spending fuels small and local businesses, providing a steady stream of income that helps keep them operational, especially in smaller towns where such expenditures can be essential to a thriving local economy.

The UMWA’s health care benefits allow retirees to afford routine and specialized medical care, supporting local hospitals, clinics, and pharmacies. By ensuring that retirees have access to health care, these funds also create demand for health care services, potentially sustaining and even creating jobs within the health care sector in these areas.

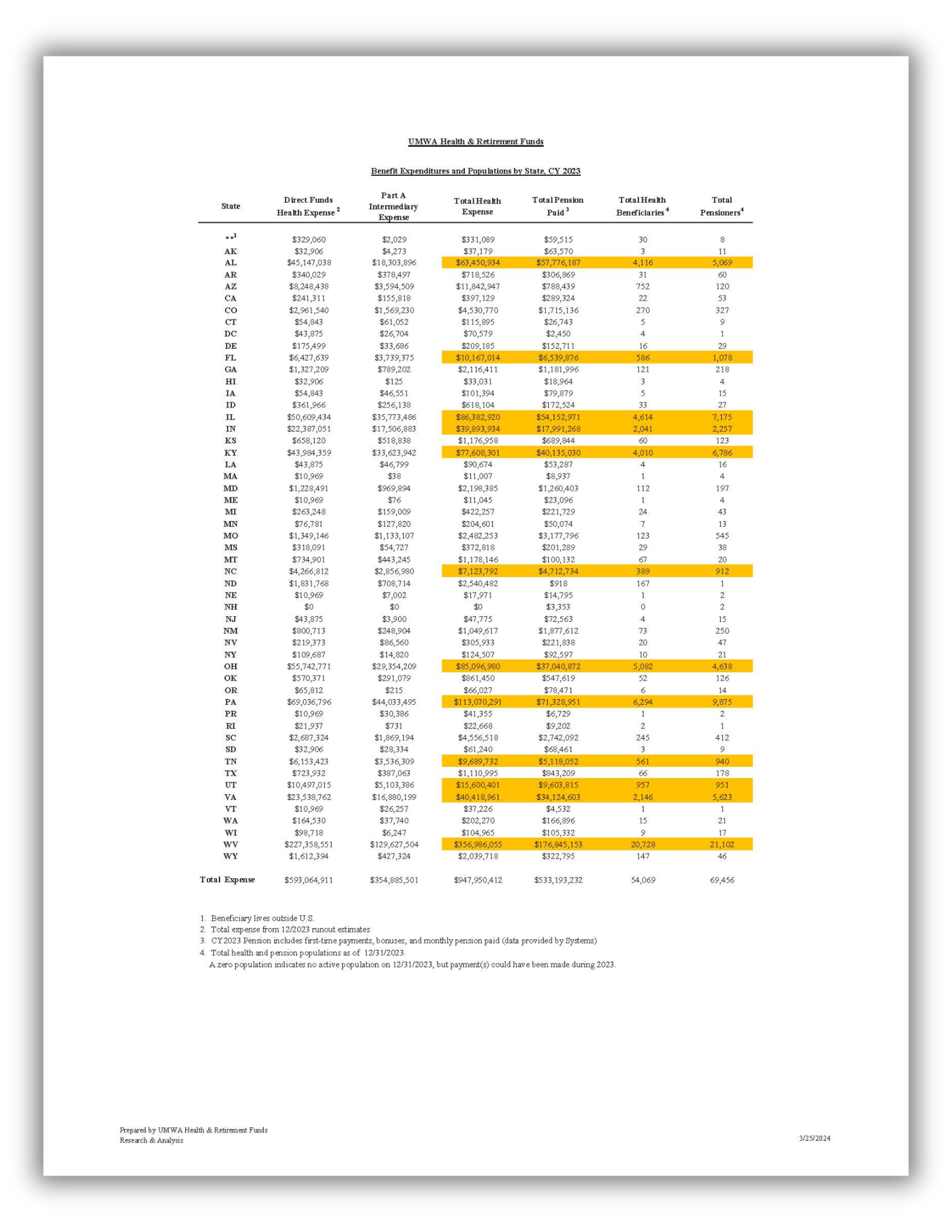

With beneficiaries spread across all 50 states, Washington D.C., Puerto Rico, and the Virgin Islands, the UMWA benefits fund has a wide-reaching economic impact. It infuses funds into diverse communities, from major metropolitan areas to rural towns, and uplifts the financial well-being of areas that might otherwise struggle to support aging populations.

For retirees and their families, these funds mean greater financial security and the ability to maintain a comfortable quality of life. UMWA benefits provide a dependable income stream, making retirement more stable and less uncertain. This is particularly significant in regions where other sources of economic support may be limited, and it provides a lifeline for surviving spouses who continue to receive support after their loved one passes away.

Families often stay in their communities, contributing to intergenerational stability, continuity, and community engagement. Moreover, as beneficiaries are financially stable, they are less likely to need state or federal assistance, reducing the burden on public welfare programs.

In summary, the UMWA Health and Retirement Funds do more than provide pensions and health care; they play a role in sustaining local economies, enhancing community stability, and promoting the well-being of retirees and their families across the nation. This extended network of support reflects the union’s long-standing commitment to its members and the broader communities they are a part of.

Take a look at how much is going to your state below.