January 20, 2022

WASHINGTON – Today, Education and Labor Committee Chairman Bobby Scott (VA-03) and Subcommittee on Workforce Protections Chairwoman Alma Adams (NC-12), introduced

the Black Lung Benefits Disability Trust Fund Solvency Act of 2022 (H.R. 6462).

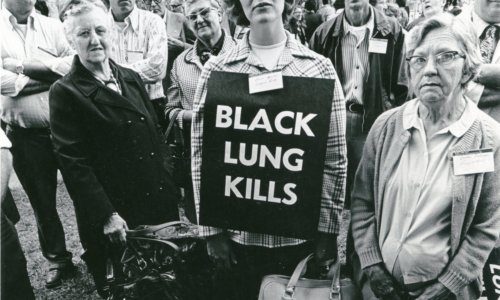

This legislation would extend the black lung excise tax rate, which expired at the end of last year, to fund future benefits and health care for miners suffering from black lung disease.

Without revenue from the tax, the Black Lung Disability Trust Fund is at risk of becoming insolvent at a time when the number of black lung cases is rapidly increasing.

A May 2018 GAO report found that failure to extend the tax rate will increase the Fund’s debt from approximately $5 billion to $15 billion by 2050.

“History shows that miners and their families will be forced to pay the price in the form of reduced eligibility for benefits if Congress allows the Black Lung Disability Trust Fund to sink deeper into debt,” said Chairman Scott (VA-03).

“The Black Lung Benefits Disability Trust Fund Solvency Act of 2022 substantially reduces that risk by protecting the long-term sustainability of the Trust Fund, while ensuring that the coal industry does not shift the cost of benefits. Given the recent rise in the most severe form of black lung disease, Congress must take action to secure future benefits and health care for disabled miners.”

“The Black Lung Benefits Disability Trust Fund Solvency Act of 2022 substantially reduces that risk by protecting the long-term sustainability of the Trust Fund, while ensuring that the coal industry does not shift the cost of benefits. Given the recent rise in the most severe form of black lung disease, Congress must take action to secure future benefits and health care for disabled miners.”

“With the number of black lung cases rapidly increasing, Congress must take action to secure health care and benefits for disabled miners. We can’t allow the Black Lung Disability Trust Fund to sink deeper into debt,” said Congresswoman Alma Adams (NC-12), chair of the Workforce Protections Subcommittee.

“Coal operators and their Wall Street creditors are gaming the system, while miners face an uncertain future and American taxpayers foot the bill. This is a failure on multiple fronts to protect American taxpayers, miners, and their families.

“The Black Lung Benefits Disability Trust Fund Solvency Act of 2022 will protect the long-term sustainability of the Trust Fund, and prevent the coal industry from shifting the cost to taxpayers. I’m proud to re-introduce this legislation with Chairman Scott.”

“Long-term funding for the Black Lung Disability Trust Fund is a necessity. Miners are suffering from Coal Workers Pneumoconiosis, or Black Lung, because they dedicated their lives providing this nation with electricity and steel. The least Congress could do is ensure that the benefits they depend on to survive will always be there,” said Cecil Roberts, President of the United Mine Workers of America.

The Black Lung Disability Trust Fund is financed primarily by a tax on coal produced and sold domestically. The tax was first established in 1978 at $0.50 per ton on underground coal and $0.25 per ton on surface coal. The funding was later raised to $1.10/ton for underground coal and $0.55/ton for surface coal.

Due to congressional inaction, however, on December 31, 2021, the tax rate reverted to $0.50 per ton on underground coal and $0.25 per ton on surface coal—a 55 percent reduction. Congressional failure to renew the tax rate will cost the trust fund an estimated $2.6 million per week.

Due to congressional inaction, however, on December 31, 2021, the tax rate reverted to $0.50 per ton on underground coal and $0.25 per ton on surface coal—a 55 percent reduction. Congressional failure to renew the tax rate will cost the trust fund an estimated $2.6 million per week.

The Trust Fund is already approximately $5 billion in debt. The Black Lung Benefits Disability Trust Fund Solvency Act would extend the black lung disease tax through December 31, 2031 to ensure that miners and black lung disease victims have access to the care and treatment they need.